What is Cost of Goods Manufactured?

The Cost of Goods Manufactured (COGM) is a crucial metric in the manufacturing industry, representing the total cost incurred by a company to produce goods that are completed within a specific accounting period. This measurement includes various components, such as direct materials, direct labor, and manufacturing overhead. Understanding COGM is essential for manufacturers to manage their production costs effectively and assess the profitability of their operations.

Direct materials refer to the raw materials that are used in the production of finished goods. This includes any materials that can be directly traced to the product, such as the metal in a car or the fabric in clothing. Direct labor encompasses the wages of the employees who are directly involved in the manufacturing process, contributing to turning raw materials into finished products. Manufacturing overhead includes all other indirect costs associated with production, such as utilities, depreciation, and indirect labor, which cannot be directly attributed to a specific product.

In essence, the Cost of Goods Manufactured not only serves as a reflection of production costs but also as an indicator of operational efficiency. A well-managed COGM process can lead to better financial health and provide valuable insights for strategic planning in the manufacturing sector.

Components of Cost of Goods Manufactured

The cost of goods manufactured (COGM) is a crucial metric for businesses that engage in manufacturing processes. It comprises various components that collectively determine the total cost incurred in producing goods during a specific period. Understanding these components can help firms manage production costs effectively. The three main categories that contribute to the COGM are direct materials, direct labor, and manufacturing overhead.

Direct materials refer to the raw materials that are integral in the production of finished goods. These materials are explicitly identifiable with the product and can include items such as steel for automotive parts or wood for furniture manufacturing. The cost is calculated by summing the expenses associated with materials purchased during the period, adjusting for any inventory changes. For instance, if a furniture manufacturer starts with $5,000 in raw materials, purchases an additional $10,000 worth during the month, and ends with $4,000 in inventory, the cost of materials used would be $11,000.

Next, direct labor encompasses the wages of employees who are directly involved in the manufacturing process. This includes the remuneration of workers who operate machinery, assemble products, or perform quality checks. Calculating direct labor involves determining the total hours worked by these employees and multiplying that by their respective hourly wage rates. For example, if a company pays its assembly workers $20 per hour and they collectively work 100 hours, the direct labor cost would amount to $2,000.

Lastly, manufacturing overhead includes all indirect costs incurred during production that cannot be directly attributed to specific products. This may consist of utilities, depreciation, and wages for supervisors. Proper allocation of manufacturing overhead is necessary for an accurate calculation of COGM. By discerning these components—direct materials, direct labor, and manufacturing overhead—companies can gain valuable insights into their production costs, leading to better financial decisions and enhanced efficiency.

Calculating Cost of Goods Manufactured

The calculation of the cost of goods manufactured (COGM) primarily involves several steps that guide an entity from its beginning inventory of work-in-progress (WIP) to the total cost of finished goods produced during a specific period. A clear understanding of this process is crucial for businesses, as it influences inventory management, pricing strategies, and overall financial health.

The first step in calculating COGM is to determine the beginning WIP inventory. This figure represents the cost of unfinished goods at the start of the accounting period. Next, it is essential to add direct materials and direct labor costs incurred during the period. Direct materials consist of raw materials that are used in production, while direct labor refers to the wages paid to workers directly involved in manufacturing the goods. After accounting for these costs, the total manufacturing costs incurred for the period is determined.

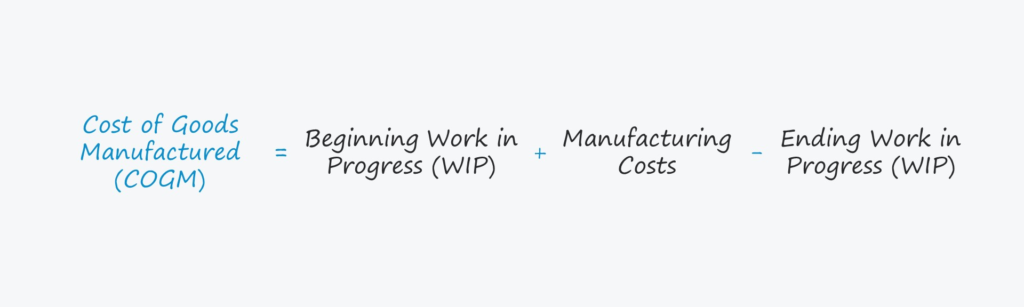

After calculating the total manufacturing costs, the next step is to account for the ending WIP inventory. This inventory includes the costs associated with any unfinished goods at the end of the period. Subtracting the ending WIP from the total manufacturing costs provides the cost of goods manufactured during that period. The formula for this calculation can be summarized as follows:

COGM = Beginning WIP + Total Manufacturing Costs – Ending WIP

To illustrate this computation, let’s consider a hypothetical example. If a company has a beginning WIP of $10,000, incurred total manufacturing costs of $50,000, and ends the period with $5,000 in WIP, we apply the formula:

COGM = $10,000 + $50,000 – $5,000 = $55,000

By understanding and applying these steps, businesses can adequately calculate the cost of goods manufactured, which is vital for accurate financial statements and informed decision-making. This method not only aids in production planning but also assists in evaluating profitability and maintaining cost efficiency.

Importance of Cost of Goods Manufactured in Business Decisions

The cost of goods manufactured (COGM) is a vital metric that significantly influences business decision-making processes. Understanding COGM allows businesses to gain insight into the total costs associated with the production of goods, including direct materials, labor, and overhead expenses. This information is essential for establishing appropriate pricing strategies. When businesses have a clear grasp of their COGM, they can set prices that not only cover costs but also ensure a desirable profit margin, thereby enhancing overall profitability.

In addition to pricing strategies, the analysis of the cost of goods manufactured plays a critical role in budgeting and financial management. Accurate COGM calculations enable businesses to allocate resources effectively and forecast future expenditures with greater precision. Managers rely on this data when preparing budgets, as it helps in identifying potential financial shortfalls or areas where savings can be realized. This proactive approach enables companies to remain competitive and responsive to changes in market conditions.

Furthermore, understanding the components of COGM allows managers to identify inefficiencies within the production process. By analyzing the specific costs associated with manufacturing, businesses can pinpoint areas where improvements can be made, such as optimizing labor use or reducing waste. This continuous improvement mindset not only diminishes costs but also enhances profit margins. Additionally, an accurate understanding of COGM assists in inventory management. Businesses that regularly evaluate their production costs and inventory levels can make informed decisions regarding stock levels, ultimately leading to better cash flow and reduced carrying costs.

In conclusion, the cost of goods manufactured is integral to shaping effective business strategies. With its influence on pricing, budgeting, efficiency identification, and inventory management, COGM serves as a foundation for informed decision-making that drives business success.

You May Also Read: